Taxes

Where can I find my tax identification number?

To access instructions on how to find your identification number, please visit OECD AEOI Portal.

Please note information here is for general use only and should not be considered as a professional advice. For personalized guidance, please consult your local tax authorities.

Is the income earned on the Crowdpear platform taxed? (non-Lithuanian tax residents)

Yes, the income earned on the Crowdpear platform is taxed based on the legislation of the country of the tax residence. Crowdpear is registered in Lithuania, therefore The State Tax Inspectorate of Lithuania (lit. VMI – Valstybinė mokesčių inspekcija) will be informed about the income investors have earned during the previous taxable (calendar) year.

Important to know for non-Lithuanian tax residents:

A 15% income tax on the interest earned will be applied to all non-Lithuanian tax residents. Taxes will be deducted at the moment of interest payment and paid to the State Tax Inspectorate of Lithuania (lit. VMI) by Crowdpear.

If you are a tax resident of a country where Lithuania has a double tax treaty exemption agreement, you can reduce the withholding tax.

It is important to note that taxes on bonuses received (i.e., when participating in the ‘Invite a friend’ program) shall be paid by investors (non-Lithuanian residents) under the legislation of the country of the tax residence.

List of countries where Lithuania has a double tax treaty exemption agreement

Is the income earned on the Crowdpear platform taxed? (Lithuanian tax residents)

Yes, the income earned on the Crowdpear platform is taxed based on the legislation of the country of the tax residence. Crowdpear is registered in Lithuania, therefore The State Tax Inspectorate of Lithuania (lit. VMI – Valstybinė mokesčių inspekcija) will be informed about the income investors have earned during the previous taxable (calendar) year.

Important to know for Lithuanian tax residents:

The State Tax Inspectorate of Lithuania (lit. VMI – Valstybinė mokesčių inspekcija) will be informed about the interest earned on the Crowdpear platform during the previous taxable (calendar) year, but it is full investor’s responsibility to declare and pay the 15% income tax from the profit earned, when income from the interest earned exceeds 500 Eur per taxable (calendar) year (interest earned up to 500 Eur is not taxed).

15% income tax for Lithuanian tax residents is also applied for the bonuses received (for example, for the bonuses received when participating in the ‘Invite a friend’ program), but taxes, in this case, are declared and paid by Crowdpear. At the moment of the bonus payment, the investor (Lithuanian tax resident) receives the bonus amount, where a 15% tax rate was already deducted.

For more information, visit the State Tax Inspectorate’s of Lithuania (lit. Valstybinė mokesčių inspekcija – VMI) website

What documents do I need to submit to reduce the taxes paid in my own country? (DAS-1)

If you are a tax resident of a country where Lithuania has a double tax treaty exemption agreement, you can reduce the withholding tax. You shall download and sign the DAS-1 form and upload it when registering or after the registration in your settings (the DAS-1 example can be found here).

Important to know about the DAS-1 form:

- The DAS-1 form must be signed (e-signatures are not accepted).

- To complete Part I of the DAS-1 form successfully, please use your passport or a national ID card you used to verify your identity on Crowdpear. The use of other documents such as a driver’s license or residence permit will lead to the rejection of your form.

- Instead of signing Part V in the DAS-1 form (‘Certificate of the Tax Authority of foreign country’), a certificate of tax residency issued and signed by the local authority may be provided with the signed DAS-1 form.

- In part III ‘Income’ -> ‘Type of income’, ‘Interest income/Income’ must be written by the investor. The date and the number of contract can be found in the user agreement (go to your account’s settings to find the user agreement).

- We recommend submitting the documents before your first investment or first repayment. In case the documents are not submitted, a standard 15% tax rate on the interest earned is applied.

- Please note that it may take 2-3 working days for the documents to be reviewed and accepted.

- DAS-1 form or DAS-1 form and a tax residency certificate shall be provided for every calendar year.

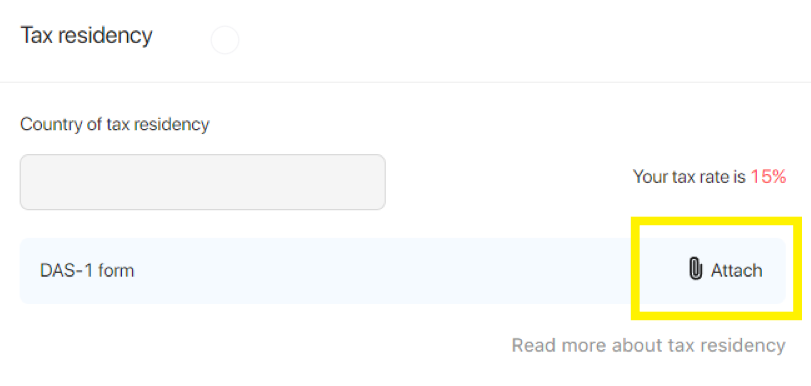

Log in to your account, navigate to ‘Settings’ and scroll down to the ‘Tax residency’ section. Click on ‘Attach’ to upload your documents.

Where and how can I upload my DAS-1 form?

Log in to your account, navigate to ‘Settings’ and scroll down to the ‘Tax residency’ section. Click on ‘Attach’ to upload your documents.

What documents do I need to submit to get tax refund for a previous taxable year? (DAS-2)

Suppose the DAS-1 form has not been submitted for the previous calendar year, an investor may fill in the DAS-2 form and contact the State Tax Inspectorate of Lithuania (lit. Valstybinė mokesčių inspekcija – VMI) directly for a tax refund for a previous taxable year.

How to submit the DAS-2 form:

- Once you have filled in Part I, send it to us by email [email protected].

- Parts II, III and IV are filled, approved, and sent back to the investor by Crowdpear. Additional documents or statements may be provided by Crowdpear, if needed.

- Make 2 copies of the document and by signing in Part V of both copies confirm that the information above (in Parts I-IV) is correct.

- Afterward, reach out to your local Tax Authority for their confirmation of you being a tax resident for a previous year in Part VI (signature on both of the copies on the DAS-2 form or a separate tax residency certificate for the previous year).

- Once you have a confirmation from your local Tax Authority (signature on the DAS-2 form or an original of an official statement), contact the State Tax Inspectorate of Lithuania (lit. Valstybinė mokesčių inspekcija – VMI) directly for a tax refund for a previous taxable year. Note that you may be asked to send the original copies to VMI.

List of countries where Lithuania has a double tax treaty exemption agreement

For more information, visit the State Tax Inspectorate’s of Lithuania (lit. Valstybinė mokesčių inspekcija – VMI) website

The investor is responsible for declaring and paying taxes in the country where the investor is registered as a tax resident.

Is the income earned on the Crowdpear for legal entities taxed? (non-Lithuanian legal entities)

Yes, the income earned on the Crowdpear platform is taxed based on the legislation of the country of the tax residence. Crowdpear is registered in Lithuania, therefore The State Tax Inspectorate of Lithuania (lit. VMI – Valstybinė mokesčių inspekcija) will be informed about the income investors have earned during the previous taxable (calendar) year.

Crowdpear does not deduct taxes from the income earned and bonuses received from legal entities registered in countries in EEA (European Economic Area) and countries where Lithuania has a double tax treaty exemption agreement. The company is responsible for declaring and paying taxes under the country’s legislation where the company is registered as a taxpayer.

A 10% tax from the income earned is deducted from legal entities registered in countries outside of the EEA (European Economic Area) or not included in the list of countries where Lithuania has a double tax treaty exemption agreement. Taxes are deducted and paid to the State Tax Inspectorate of Lithuania (lit. VMI – Valstybinė mokesčių inspekcija) by Crowdpear. It is important to note that taxes on bonuses received (i.e., when participating in the ‘Invite a friend program) shall be paid by the legal entities under the legislation of the country where the company is registered as a taxpayer.

European Economic Area (EEA)

Is the income earned on the Crowdpear for legal entities taxed? (Lithuanian legal entities)

Yes, the income earned on the Crowdpear platform is taxed based on the legislation of the country of the tax residence. Crowdpear is registered in Lithuania, therefore The State Tax Inspectorate of Lithuania (lit. VMI – Valstybinė mokesčių inspekcija) will be informed about the income investors have earned during the previous taxable (calendar) year.

Crowdpear does not deduct taxes from the income earned, and bonuses received. Declaring and paying taxes to the State Tax Inspectorate of Lithuania (lit. VMI – Valstybinė mokesčių inspekcija) is the legal entity’s obligation.