Frequently asked questions

Secondary market

What is a secondary market?

A secondary market is a functionality (system) of the platform, where investors can sell their current (not finished) investments. At the moment of sale, the buyer acquires the claim rights of the seller against the borrower, arising from the corresponding loan agreement (to repay the loan, pay interest, late fees, and other related payments).

All investors can sell their current investments on the secondary market. To be able to purchase an investment, investors must successfully verify their identity, fill in the investor‘s questionnaire, and hold enough funds to buy the investment offered on the platform‘s secondary market. The same conditions apply to the investments purchased in the secondary and primary markets.

Was this helpful?

How to sell the investments on the secondary market?

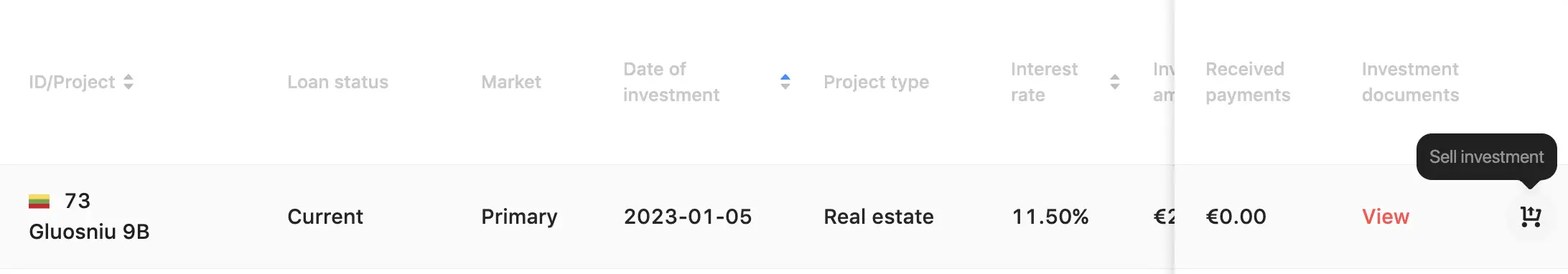

Open ‘My investments’ -> ‘Funded projects’ on your account, choose the investment you want to sell, and press on the icon ‘Sell investment’:

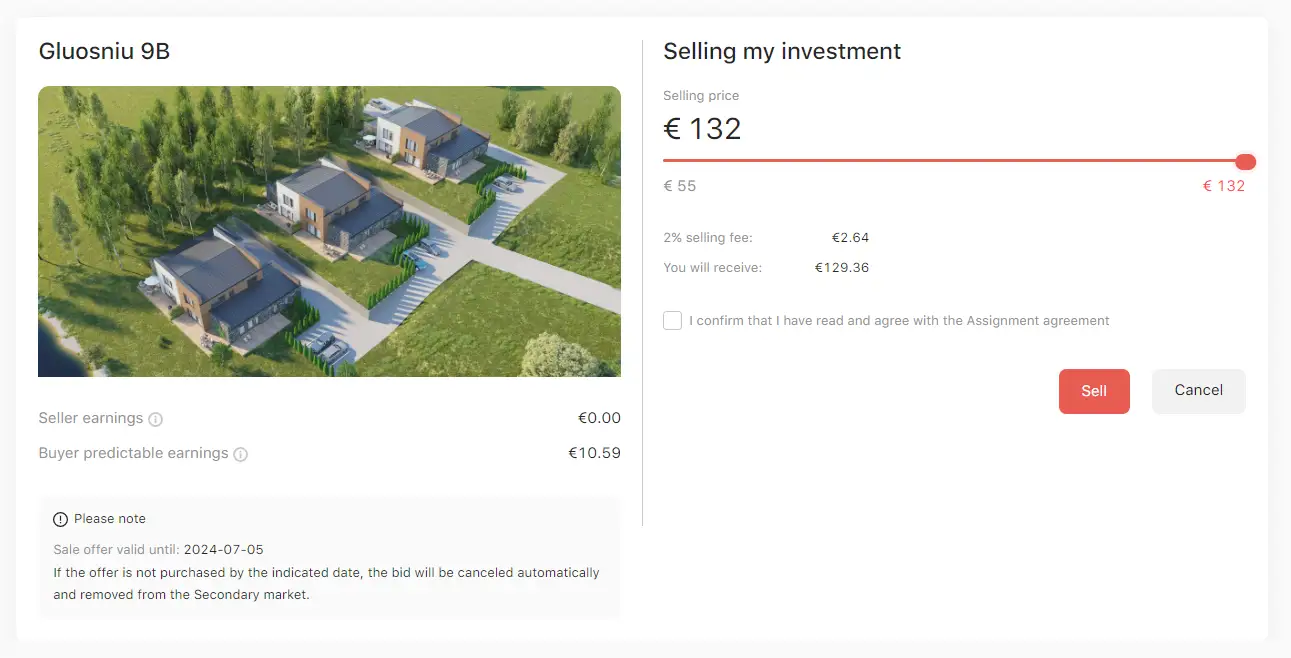

Then set the preferred sale price (maximum premium price limit is +20%), and the calculator will show the amount you will receive after the sale (a 2% selling fee of the selling price is applied by the platform and will be deducted at the moment of sale), and the buyer‘s predictable earnings. ‘Seller earnings’ indicate the investor’s (seller’s) earnings gained throughout the investment period up to date.

By pressing ‘Sell’, you will confirm and share your sale offer on the platform’s secondary market (the offer will be active for 14 calendar days; if the investment is not purchased over this period, the offer will be automatically canceled).

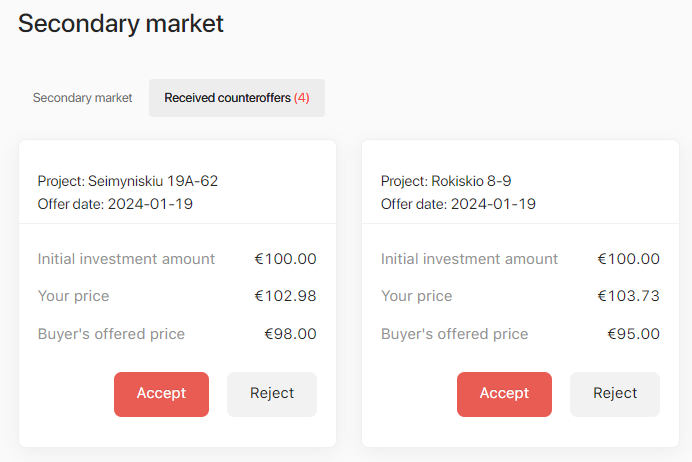

All buyers on the Secondary market can submit a counteroffer of their preferred purchase price, which the seller can accept or reject. All received offers will be available in your account’s ‘Secondary market’ -> ‘Received counteroffers’ section. Press ‘Accept’ if the offered price suits you and ‘Reject’ if it does not meet your expectations. The accepted offer will be processed successfully if the buyer’s available funds are sufficient; if not, the offer will be automatically rejected by the system. All other received counteroffers are automatically canceled once the accepted counteroffer is successfully processed.

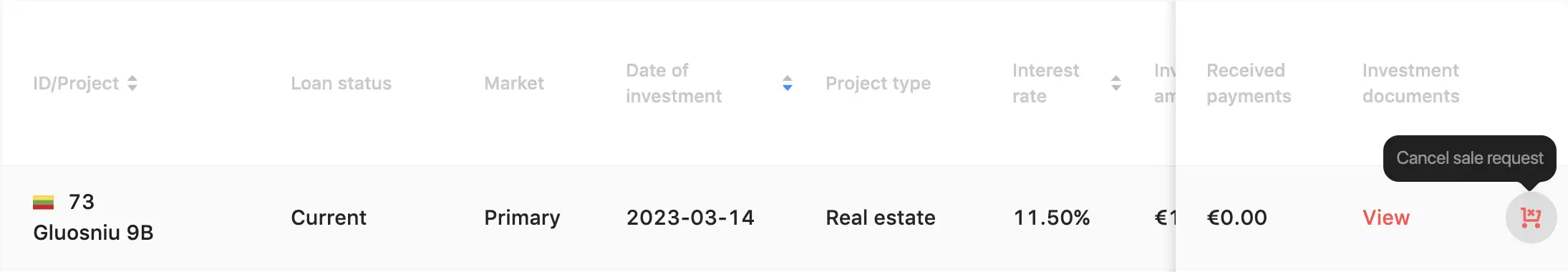

If you have changed your mind, you can cancel the sale offer at any time until it is purchased by another investor. To cancel, go to ‘My investments’ -> ‘Funded projects’, and press on the red icon ‘Cancel sale request’:

After a successful sale, your investment will be moved to the ‘My investments’ -> ‘Finished investments’ section.

Important to note:

- Investments cannot be partially sold or sold before the total loan amount is not collected;

- All additional interest rates or bonuses applied to an investment will be transferred to the buyer (together with the claim rights of the seller against the borrower, arising from the corresponding loan agreement), e.g.: if an investment had an additional +1% Welcome bonus applied (totaling to 11,5% interest rate applied for the investment), the same interest rate remains once the investment is purchased by another investor;

- If a late investment would be sold, all future payments would be processed to the buyer (the seller has no claim right against the borrower after the sale of the investment);

- A sale offer would be automatically canceled if any new repayments according to the project’s payment schedule would be processed (or full loan amount would be covered);

- After a successful sale, funds will reach your Crowdpear account right away.

Was this helpful?

Are there any fees applied in the secondary market?

The platform applies a 2% claim right transfer fee to the seller (the 2% fee of the selling price is deducted automatically at the moment of sale). There are no fees for the buyers in the secondary market.

Was this helpful?

How to purchase the investments on the secondary market?

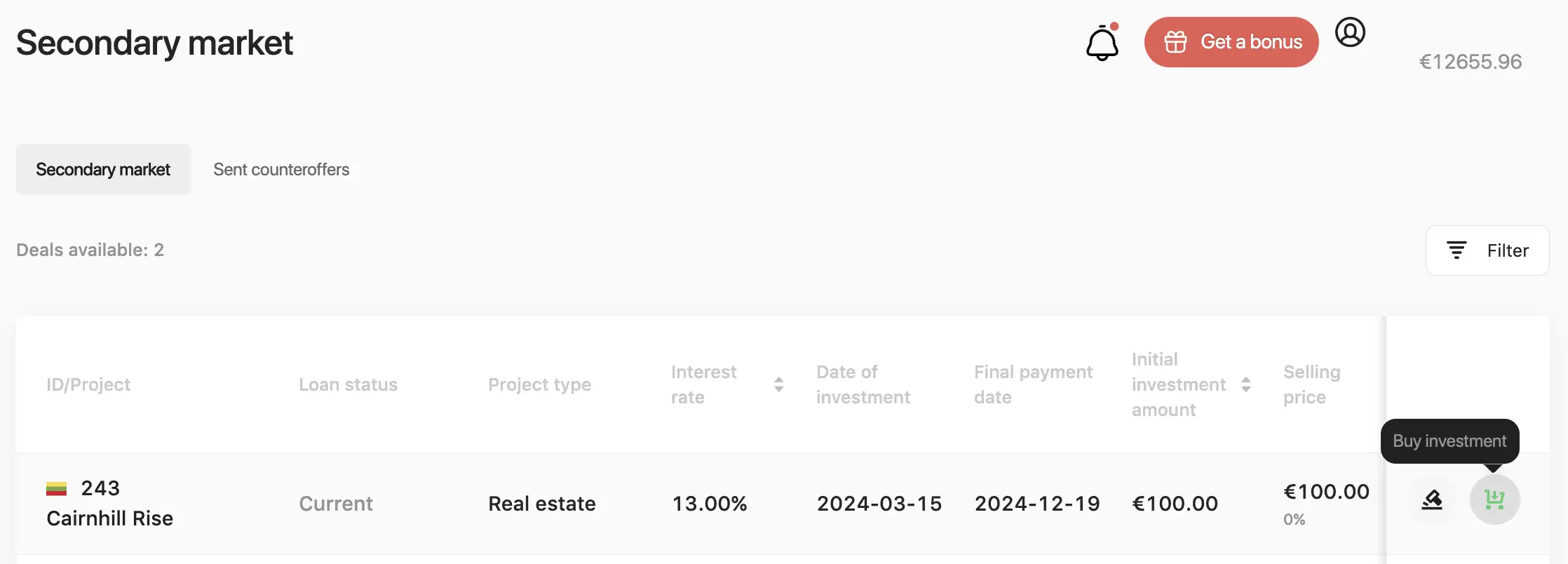

Go to ‘Invest‘ -> ‘Secondary market‘ section, choose an investment you want to purchase on the secondary market, and press the cart icon ‘Buy investment‘:

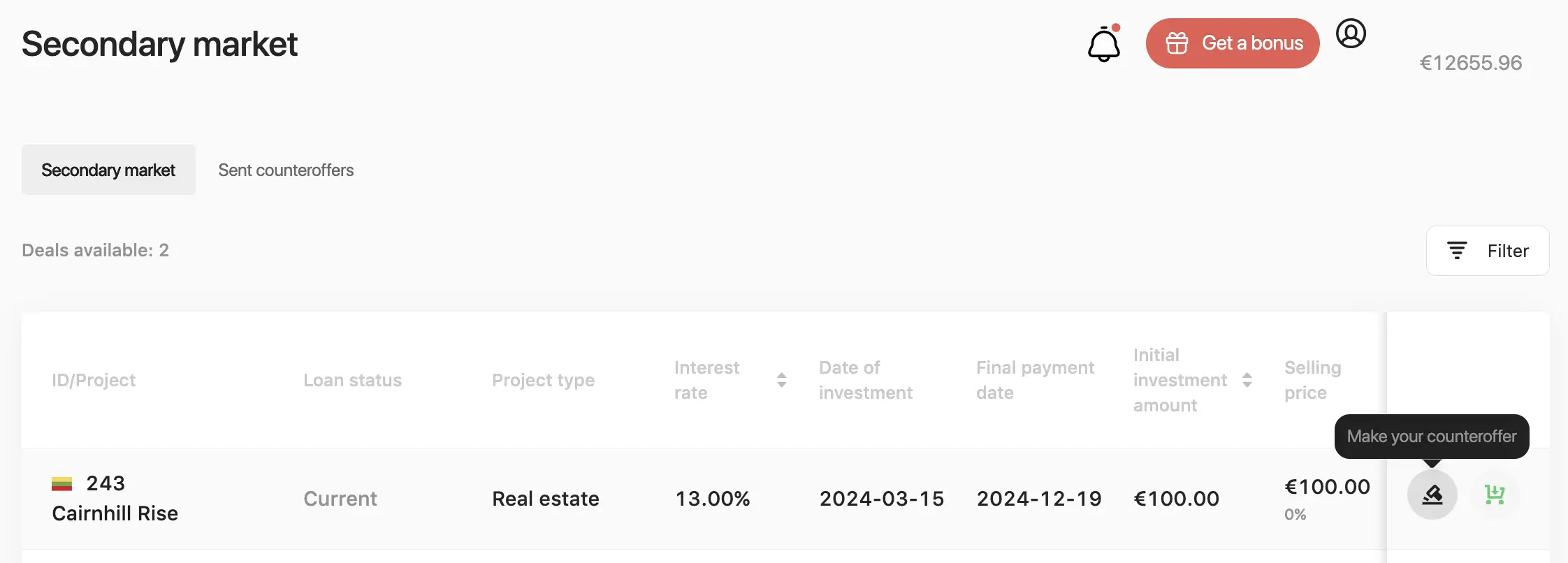

You may also offer your purchase price by pressing ‘Make your counteroffer’. The maximum discount you can get by submitting a counteroffer is 50% of the selling price.

Only one purchase offer may be submitted per investment on the secondary market (you have the option to cancel your counteroffer at any time). The offer is valid until it is accepted or rejected by the seller or automatically canceled by the system (if the buyer’s funds are insufficient or another offer was accepted).

After a successful purchase, the investment will appear in your Crowdpear account‘s ‘My investments‘ -> ‘Funded projects‘ section. You will acquire all the claim rights from the seller against the borrower, arising from the corresponding loan agreement (to repay the loan, pay Interest, late fees, and other related payments). There are no fees for the buyers in the secondary market.

In case you would want to sell an investment purchased on the secondary market, the option to sell the investment would be available only after 1 day after a successful purchase. Information on how to sell the investments on the secondary market can be found here.