Investments

How is the interest calculated?

A total period of how many days there are between the investment’s start date and the final (closing) date is taken into calculation. The total investment days number is calculated using the ‘DAYS360’ function, which may be found here.

What is the minimum period for which interest is calculated?

Interest is calculated for investments that have a duration of more than 24 hours.

What does the LTV mean?

LTV (Loan-To-Value) indicator is used to express the ratio of a loan to the value of an asset. An LTV ratio is calculated by dividing the amount borrowed by the asset value x 100. For example, the asset is worth 10 000 Eur, the amount borrowed is 7 000 Eur, the LTV is 70%.

A lower LTV indicator means that a greater part of assets is pledged.

Please note that no project on the Crowdpear platform will have an LTV ratio higher than 80%.

How often are investments repaid?

Depending on the loan schedule, investments are repaid monthly or quarterly. With every repayment, a part of the calculated interest is repaid, the principal amount is paid after the loan is closed.

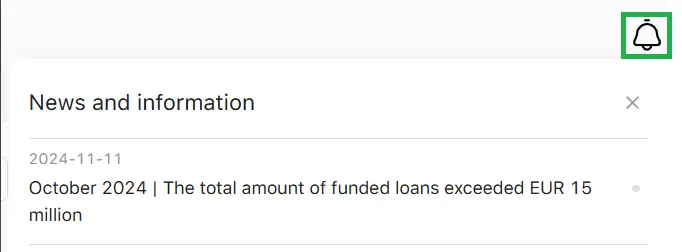

In some cases, partial loan repayments may occur, and further information will be available in the ‘News’ section of your Crowdpear account. Alternatively, feel free to contact Client Support for additional assistance.

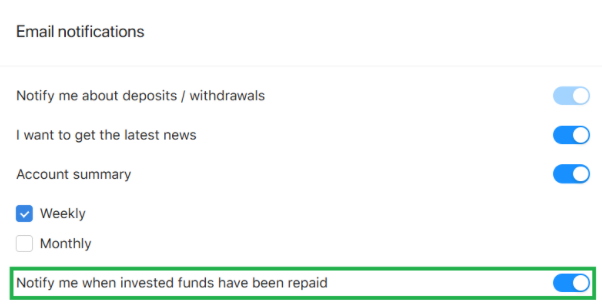

To receive email notifications regarding the repayment of invested funds, please navigate to ‘Personal Settings’ and select the option ‘Notify me when invested funds have been repaid’.

Where can I see how much I have earned?

You can see it in the ‘Overview’ -> ‘Profit status’ -> ‘All time profit’ section and in the ‘Statement’ -> ‘Interest income’ section.

Can I sell or cancel my current investments?

Yes, you can sell your current (not finished) investments on the secondary market. A 2% selling fee of the selling amount is applied by the platform and will be deducted at the moment of sale. Read more about the secondary market here.

If you are classified as an inexperienced (non-sophisticated) investor, you have the option to cancel your investment within 4 (four) calendar days from the investment day. To cancel your investment, kindly contact Crowdpear Client Support. You can find this information, as well as other relevant documents here.

What happens when the required amount for a loan is not collected?

If the required loan amount is not reached, the collection of investments for the project is canceled. Full principal amount + interest earned from the start of the investment until the cancelation of the project date is returned to investors.

Can the borrower repay the loan earlier?

Yes, a loan can be fully or partially repaid by the borrower earlier.

If a loan would be fully repaid earlier, the full investment amount + interest earned until the closing date is paid to investors. Please note that, depending on the specific project and the terms outlined in the agreement with the project developer, investors may receive additional interest.

In case a loan is partially repaid, the received repayment amount from the borrower would be divided proportionally among investors. The same interest rate would continue to be applied to the remaining investment amount.

If you need clarification on the interest calculations, feel free to contact our Client Support.

What is Annual Return?

Annual return measures the actual rate of return of all your investments for the current year. It includes anything that affects your returns, such as delays, bonuses, and purchases/sellings on the secondary market.

At the beginning (if you have started investing recently) Annual return is displayed higher or lower (depends on the invested amount), as we include in the calculation counted but not paid yet interest value. Within a couple of months, the annual return reaches the normal level/is displayed correctly.

Annual Return is calculated using the XIRR (extended internal rate of return) calculation methodology. More information about the XIRR and calculation formula can be found here.