Investments & Loan protection

Where can I find my tax identification number?

To access instructions on how to find your identification number, please visit OECD AEOI Portal.

Please note information here is for general use only and should not be considered as a professional advice. For personalized guidance, please consult your local tax authorities.

Is the income earned on the Crowdpear platform taxed? (non-Lithuanian tax residents)

Yes, the income earned on the Crowdpear platform is taxed based on the legislation of the country of the tax residence. Crowdpear is registered in Lithuania, therefore The State Tax Inspectorate of Lithuania (lit. VMI – Valstybinė mokesčių inspekcija) will be informed about the income investors have earned during the previous taxable (calendar) year.

Important to know for non-Lithuanian tax residents:

A 15% income tax on the interest earned will be applied to all non-Lithuanian tax residents. Taxes will be deducted at the moment of interest payment and paid to the State Tax Inspectorate of Lithuania (lit. VMI) by Crowdpear.

If you are a tax resident of a country where Lithuania has a double tax treaty exemption agreement, you can reduce the withholding tax.

It is important to note that taxes on bonuses received (i.e., when participating in the ‘Invite a friend’ program) shall be paid by investors (non-Lithuanian residents) under the legislation of the country of the tax residence.

List of countries where Lithuania has a double tax treaty exemption agreement

Is the income earned on the Crowdpear platform taxed? (Lithuanian tax residents)

Yes, the income earned on the Crowdpear platform is taxed based on the legislation of the country of the tax residence. Crowdpear is registered in Lithuania, therefore The State Tax Inspectorate of Lithuania (lit. VMI – Valstybinė mokesčių inspekcija) will be informed about the income investors have earned during the previous taxable (calendar) year.

Important to know for Lithuanian tax residents:

The State Tax Inspectorate of Lithuania (lit. VMI – Valstybinė mokesčių inspekcija) will be informed about the interest earned on the Crowdpear platform during the previous taxable (calendar) year, but it is full investor’s responsibility to declare and pay the 15% income tax from the profit earned, when income from the interest earned exceeds 500 Eur per taxable (calendar) year (interest earned up to 500 Eur is not taxed).

15% income tax for Lithuanian tax residents is also applied for the bonuses received (for example, for the bonuses received when participating in the ‘Invite a friend’ program), but taxes, in this case, are declared and paid by Crowdpear. At the moment of the bonus payment, the investor (Lithuanian tax resident) receives the bonus amount, where a 15% tax rate was already deducted.

For more information, visit the State Tax Inspectorate’s of Lithuania (lit. Valstybinė mokesčių inspekcija – VMI) website

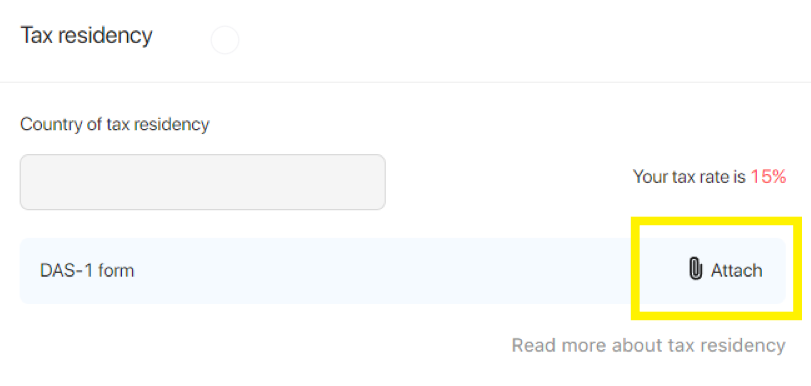

What documents do I need to submit to reduce the taxes paid in my own country? (DAS-1)

If you are a tax resident of a country where Lithuania has a double tax treaty exemption agreement, you can reduce the withholding tax. You shall download and sign the DAS-1 form and upload it when registering or after the registration in your settings (the DAS-1 example can be found here).

Important to know about the DAS-1 form:

- The DAS-1 form must be signed (e-signatures are not accepted).

- To complete Part I of the DAS-1 form successfully, please use your passport or a national ID card you used to verify your identity on Crowdpear. The use of other documents such as a driver’s license or residence permit will lead to the rejection of your form.

- Instead of signing Part V in the DAS-1 form (‘Certificate of the Tax Authority of foreign country’), a certificate of tax residency issued and signed by the local authority may be provided with the signed DAS-1 form.

- In part III ‘Income’ -> ‘Type of income’, ‘Interest income/Income’ must be written by the investor. The date and the number of contract can be found in the user agreement (go to your account’s settings to find the user agreement).

- We recommend submitting the documents before your first investment or first repayment. In case the documents are not submitted, a standard 15% tax rate on the interest earned is applied.

- Please note that it may take 2-3 working days for the documents to be reviewed and accepted.

- DAS-1 form or DAS-1 form and a tax residency certificate shall be provided for every calendar year.

Log in to your account, navigate to ‘Settings’ and scroll down to the ‘Tax residency’ section. Click on ‘Attach’ to upload your documents.

Where and how can I upload my DAS-1 form?

Log in to your account, navigate to ‘Settings’ and scroll down to the ‘Tax residency’ section. Click on ‘Attach’ to upload your documents.

What documents do I need to submit to get tax refund for a previous taxable year? (DAS-2)

Suppose the DAS-1 form has not been submitted for the previous calendar year, an investor may fill in the DAS-2 form and contact the State Tax Inspectorate of Lithuania (lit. Valstybinė mokesčių inspekcija – VMI) directly for a tax refund for a previous taxable year.

How to submit the DAS-2 form:

- Once you will fill in Part I, send it to us by email [email protected].

- Parts II, III and IV are filled, approved, and sent back to the investor by Crowdpear. Additional documents or statements may be provided by Crowdpear, if needed.

- Make 2 copies of the document and by signing in Part V of both copies confirm that the information above (in Parts I-IV) is correct.

- Afterward, reach out to your local Tax Authority for their confirmation of you being a tax resident for a previous year in Part VI (signature on both of the copies on the DAS-2 form or a separate tax residency certificate for the previous year).

- Once you have a confirmation from your local Tax Authority (signature on the DAS-2 form or an original of an official statement), contact the State Tax Inspectorate of Lithuania (lit. Valstybinė mokesčių inspekcija – VMI) directly for a tax refund for a previous taxable year. Note that you may be asked to send the original copies to VMI.

List of countries where Lithuania has a double tax treaty exemption agreement

For more information, visit the State Tax Inspectorate’s of Lithuania (lit. Valstybinė mokesčių inspekcija – VMI) website

The investor is responsible for declaring and paying taxes in the country where the investor is registered as a tax resident.

Is the income earned on the Crowdpear for legal entities taxed? (non-Lithuanian legal entities)

Yes, the income earned on the Crowdpear platform is taxed based on the legislation of the country of the tax residence. Crowdpear is registered in Lithuania, therefore The State Tax Inspectorate of Lithuania (lit. VMI – Valstybinė mokesčių inspekcija) will be informed about the income investors have earned during the previous taxable (calendar) year.

Crowdpear does not deduct taxes from the income earned and bonuses received from legal entities registered in countries in EEA (European Economic Area) and countries where Lithuania has a double tax treaty exemption agreement. The company is responsible for declaring and paying taxes under the country’s legislation where the company is registered as a taxpayer.

A 10% tax from the income earned is deducted from legal entities registered in countries outside of the EEA (European Economic Area) or not included in the list of countries where Lithuania has a double tax treaty exemption agreement. Taxes are deducted and paid to the State Tax Inspectorate of Lithuania (lit. VMI – Valstybinė mokesčių inspekcija) by Crowdpear. It is important to note that taxes on bonuses received (i.e., when participating in the ‘Invite a friend program) shall be paid by the legal entities under the legislation of the country where the company is registered as a taxpayer.

European Economic Area (EEA)

Is the income earned on the Crowdpear for legal entities taxed? (Lithuanian legal entities)

Yes, the income earned on the Crowdpear platform is taxed based on the legislation of the country of the tax residence. Crowdpear is registered in Lithuania, therefore The State Tax Inspectorate of Lithuania (lit. VMI – Valstybinė mokesčių inspekcija) will be informed about the income investors have earned during the previous taxable (calendar) year.

Crowdpear does not deduct taxes from the income earned, and bonuses received. Declaring and paying taxes to the State Tax Inspectorate of Lithuania (lit. VMI – Valstybinė mokesčių inspekcija) is the legal entity’s obligation.

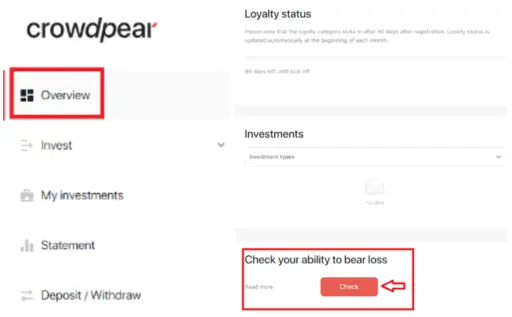

How can I assess my ability to bear loss?

Crowdpear provides a tool that allows investors to assess their capacity for accepting losses. The calculator to check your ability to bear loss can be found in the ‘Overview’ section of each investor’s personal account.

It is important to note that you cannot make investments until you have not filled out the Investor questionnaire and successfully assessed your ability to bear loss using the calculator (if the situation requires, recalculation could be done at any time). When performing the modeling of the capacity for loss, the net value of the Investor is calculated as follows:

Net value of the investor assets = (net annual income) + (total liquid assets) – (annual financial liabilities)

For more information, please refer to the Procedure for assessing the suitability of crowdfunding transactions and modelling of the capacity for loss.

Note: users must refill the ability to bear loss calculator every two years to continue investing.

Why am I considered an inexperienced (non-sophisticated) investor?

Based on the requirements of the Regulation and other applicable legal acts, as a crowdfunding service provider, we must request information about the investors’ experience, investment goals, financial situation, and a general understanding of the investment related risks. We must evaluate whether the offered crowdfunding services are suitable for investors, and based on the criteria, consider them inexperienced (non-sophisticated) or experienced (sophisticated), and additionally warn them about the risks of investing in the types of investments offered on the platform, when required.

To ensure higher investor protection, Crowdpear considers all investors as inexperienced (non-sophisticated) investors. If you meet the criteria provided in the Procedure for assessing the suitability of crowdfunding transactions and modelling of the capacity for loss to be classified as an experienced (sophisticated) investor, contact our Client Support along with relevant evidence confirming compliance with the established criteria. A summary of the steps and criteria to be considered as an experienced (sophisticated) investor can be found here.

How is the interest calculated?

A total period of how many days there are between the investment’s start date and the final (closing) date is taken into calculation. The total investment days number is calculated using the ‘DAYS360’ function, which may be found here.

What is the minimum period for which interest is calculated?

Interest is calculated for investments that have a duration of more than 24 hours.

What does the LTV mean?

LTV (Loan-To-Value) indicator is used to express the ratio of a loan to the value of an asset. An LTV ratio is calculated by dividing the amount borrowed by the asset value x 100. For example, the asset is worth 10 000 Eur, the amount borrowed is 7 000 Eur, the LTV is 70%.

A lower LTV indicator means that a greater part of assets is pledged.

Please note that no project on the Crowdpear platform will have an LTV ratio higher than 80%.

How often are investments repaid?

Depending on the loan schedule, investments are repaid monthly or quarterly. With every repayment, a part of the calculated interest is repaid, the principal amount is paid after the loan is closed.

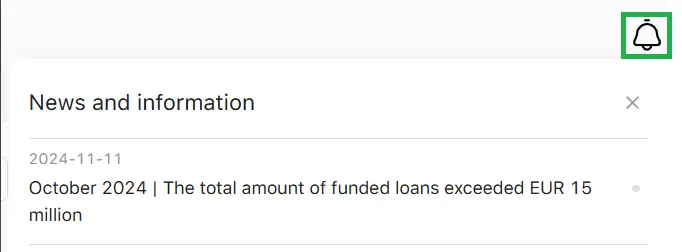

In some cases, partial loan repayments may occur, and further information will be available in the ‘News’ section of your Crowdpear account. Alternatively, feel free to contact Client Support for additional assistance.

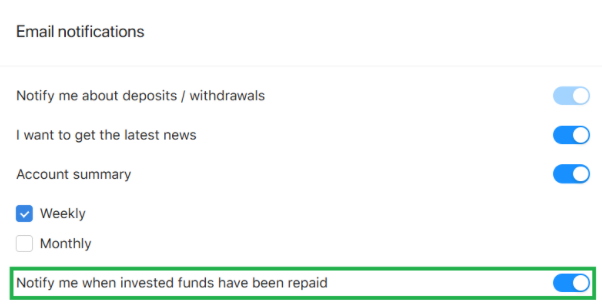

To receive email notifications regarding the repayment of invested funds, please navigate to ‘Personal Settings’ and select the option ‘Notify me when invested funds have been repaid’.

What shall I do to be considered as an experienced (sophisticated) investor on the Crowdpear platform?

To be considered a sophisticated (experienced) investor, private investors shall meet at least two of the following criteria (Paragraph 3 of the Procedure for assessing the suitability of crowdfunding transactions and modelling of the capacity for loss):

- Your personal gross income shall not be lower than EUR 60,000 per fiscal year or you shall hold a portfolio of financial instruments of at least EUR 100,000 (consisting of cash deposits and financial assets);

- You shall be working (or have been working) in the financial sector for at least one year (in a professional position that requires knowledge of the expected transactions or services), or you shall hold (or should have held) a managerial position in a legal entity for at least 12 months (legal entity that corresponds to at least one of the criteria established in paragraph 3.1.1 of the Procedure for assessing the suitability of crowdfunding transactions and modelling of the capacity for loss);

- In the last 12 months, you shall have executed an average of 10 large transactions per quarter in the capital markets or through crowdfunding service providers.

Companies shall meet at least one of the following criteria:

- Hold at least EUR 100,000 of own resources;

- Net turnover of at least EUR 2,000,000;

- Balance of at least EUR 1,000,000;

- Entities operating in the field of financial markets who received relevant permits (licenses) from supervisory authorities and are supervised by supervisory authorities (please refer to the Procedure for assessing the suitability of crowdfunding transactions and modelling of the capacity for loss for the information on entities considered);

- National or regional authorities, including public authorities managing public debt ar the national or regional level, central banks, international and supranational institutions;

- Institutional investor whose main activity is investment in financial instruments, including entities engaged in securitization and other financing transactions.

You shall send us a filled ‘Annex No 1’ form (available in the Procedure for assessing the suitability of crowdfunding transactions and modelling of the capacity for loss document) along with relevant evidence confirming compliance with the established criteria. Once the documents are reviewed and the sophisticated (experienced) investor status is approved (the status won’t be shown on your account, only internally), the application is valid for 2 years.

It is important to note that sophisticated (experienced) investors do not have a right to withdraw their financing offer within 4 calendar days from the submission of the offer. Non-sophisticated (inexperienced) investors have a right to withdraw their financing offer within 4 calendar days from the investment day (the financing offer can be withdrawn by contacting Crowdpear in writing).

Please note that the procedure for assessing the suitability of crowdfunding transactions (investors’ categorization) is prepared in accordance with the requirements of the Regulation and other applicable legal acts.

Where can I see how much I have earned?

You can see it in the ‘Overview’ -> ‘Profit status’ -> ‘All time profit’ section and in the ‘Statement’ -> ‘Interest income’ section.

Can I sell or cancel my current investments?

Yes, you can sell your current (not finished) investments on the secondary market. A 2% selling fee of the selling amount is applied by the platform and will be deducted at the moment of sale. Read more about the secondary market here.

If you are classified as an inexperienced (non-sophisticated) investor, you have the option to cancel your investment within 4 (four) calendar days from the investment day. To cancel your investment, kindly contact Crowdpear Client Support. You can find this information, as well as other relevant documents here.

What happens when the required amount for a loan is not collected?

If the required loan amount is not reached, the collection of investments for the project is canceled. Full principal amount + interest earned from the start of the investment until the cancelation of the project date is returned to investors.

Can the borrower repay the loan earlier?

Yes, a loan can be fully or partially repaid by the borrower earlier.

If a loan would be fully repaid earlier, the full investment amount + interest earned until the closing date is paid to investors. Please note that, depending on the specific project and the terms outlined in the agreement with the project developer, investors may receive additional interest.

In case a loan is partially repaid, the received repayment amount from the borrower would be divided proportionally among investors. The same interest rate would continue to be applied to the remaining investment amount.

If you need clarification on the interest calculations, feel free to contact our Client Support.

What is Annual Return?

Annual return measures the actual rate of return of all your investments for the current year. It includes anything that affects your returns, such as delays, bonuses, and purchases/sellings on the secondary market.

At the beginning (if you have started investing recently) Annual return is displayed higher or lower (depends on the invested amount), as we include in the calculation counted but not paid yet interest value. Within a couple of months, the annual return reaches the normal level/is displayed correctly.

Annual Return is calculated using the XIRR (extended internal rate of return) calculation methodology. More information about the XIRR and calculation formula can be found here.

How Crowdpear assesses the risk when selecting projects for investment?

Each application and its documentation are evaluated based on internal and risk assessment schemes. Borrower’s reputation is not only assessed based on the real estate and other assets owned that would be used as collateral, but also by checking the creditworthiness, financial liabilities, various registries whether there are or have been any lawsuits/cases/financial crimes, etc. that may have an impact on the financial reliability of the borrower.

Based on the assessment algorithms, any of the following categories may be given to the project owner:

Class 1 (A) (Very good) – low credit risk

Class 2 (B) (Good) – average credit risk

Class 3 (C) (Average) – higher credit risk

Class 4 (D) (Poor) – high credit risk

Class 5 (E) (Very poor) – too high credit risk

A risk level assigned is indicated in the project details and the project owner’s description.

Crowdpear has a right to decline a funding request if a project is considered too risky, compelling, or for any other reason, that may remain disclosed.

For more information please refer to Rules for reliability assessment of the project owners available in our Documents section here.

What risks can be met when investing on the Crowdpear platform?

Crowdpear ensures that every project is secured by the real estate pledge or other guarantees. However, an investor has to evaluate the fact that capital and income gained from all investments are at risk.

It is important to note that investments on the Crowdpear platform are not covered by the law on insurance of deposits and liabilities to investors in Lithuania and are not subject to the deposit guarantee systems and investor compensation schemes set out in directives of the European Parliament and of the Council.

For more information, please refer to the Description of risks related to investment in Crowdpear platform, which is available in our Documents section here.

How are investments protected?

Every project on the Crowdpear platform is covered by a primary or secondary mortgage on real estate or other guarantees (such as a pledge on other assets, personal surety, or guarantees). The type of guarantee applied may be seen in every project’s details and may differ for each investment.

It is important to note that investments on the Crowdpear platform are not covered by the law on insurance of deposits and liabilities to investors in Lithuania and are not subject to the deposit guarantee systems and investor compensation schemes set out in directives of the European Parliament and of the Council.

For more information, please refer to the Description of risks related to investment in Crowdpear platform, which is available in our Documents section here.

Can my investment become late?

Please note that some delays in interest payments may occur due to the specifics of the real estate industry. We may expect delays when the funded property is in the sale process; the borrower is waiting for payments from related parties, the loan is being refinanced, etc. Usually, payment delays of up to one week are considered normal.

If the interest payments under the loan payment schedule are overdue, for every day of the delay, an additional 5% yearly interest would be applied for each investment (the accumulated overdue interest amount would be processed with the last payment). In case of the project owner’s insolvency, interest will no longer accumulate starting from the day the court determines the insolvency (as per criteria established in Section 28, Clause 1, Point 4 of the Law on insolvency of legal entities of the Republic of Lithuania).

Regarding longer delays, investors are notified via a separate message in their Crowdpear account’s news section. If you haven’t received any updates after a reasonable period, feel free to contact Client Support for assistance.

A loan would be considered late if the borrower would not repay the loan after the end of the loan agreement schedule. If the borrower could not return the loan within the timeframe indicated in the agreement, Crowdpear would terminate the contract with the project owner and would initiate a legal recovery process following the normative acts valid in the Republic of Lithuania and in the EU (such project would be displayed as ‘In recovery’ status).

For more information, please refer to the Procedure for management of defaults and Loan agreement. General conditions documents, available here.

What happens if the borrower is not able to repay?

In case a borrower is not able to repay the loan, and no solution would be found directly between the borrower and Crowdpear (for example, refinancing of the loan), Crowdpear would terminate the contract with the project owner and would initiate a legal recovery process following the normative acts valid in the Republic of Lithuania and in the EU (such project would be displayed as ‘In recovery’ status).

Note that for each day of overdue interest payment, an additional 5% yearly interest would be applied for each investment (accumulated overdue interest amount would be processed with the last payment). In case of the project owner’s insolvency, interest will no longer accumulate starting from the day the court determines the insolvency (as per criteria established in Section 28, Clause 1, Point 4 of the Law on insolvency of legal entities of the Republic of Lithuania).

For more information, please refer to the Procedure for management of defaults available in our Documents here.