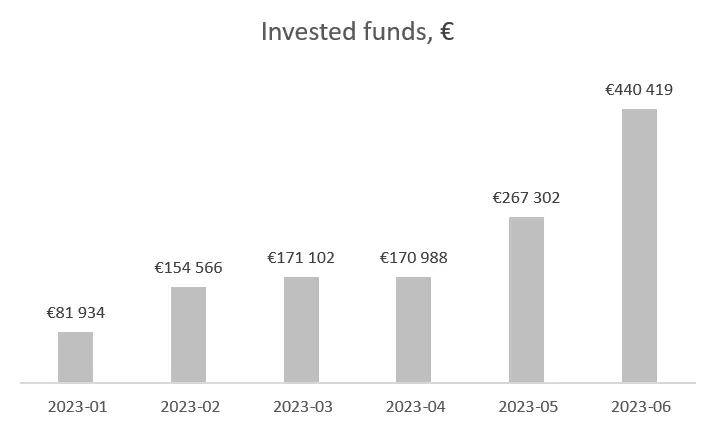

In Q2, EUR 878 709 was invested in loans on the Crowdpear platform, i.e., 115% more than in the previous quarter.

At the end of June, Crowdpear’s portfolio amounted to EUR 1,3 million.

Last quarter, our investors fully funded 18 real estate projects. In total, 25 projects in Lithuania’s largest cities and regions have already been funded on the platform this year.

The average LTV of projects offered on the Crowdpear platform is 52%.

The average annual ROI on Crowdpear was 11,2% at the end of June.

In Q2, Crowdpear investors received EUR 13 641,65 in interest.

Currently, Crowdpear has 2756 investors, 30% of which actively invest on our platform.

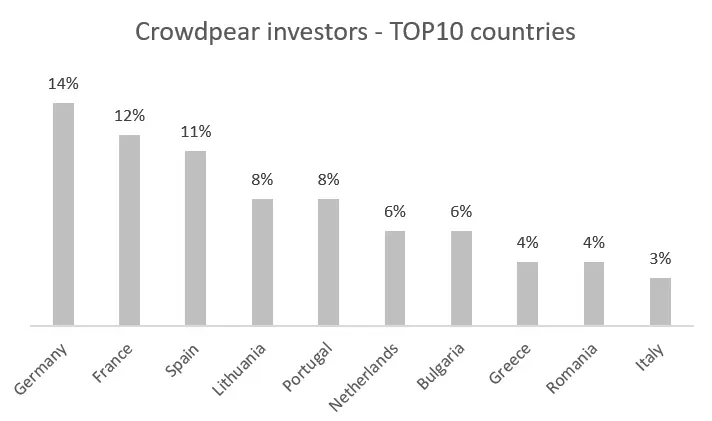

Crowdpear has the most investors from Germany, France, Spain, Lithuania, Portugal, the Netherlands, Bulgaria, Greece, Romania, and Italy.

Last quarter, in May, Crowdpear introduced a Secondary market on the platform. In June, the platform offered investors a counteroffer solution on the secondary market, which allows investors to negotiate the price of investments sold on the secondary market.

In Q2, Crowdpear increased its share capital from EUR 60 000 to EUR 130 000, which is a part of the final stage of receiving an ECSPR license.