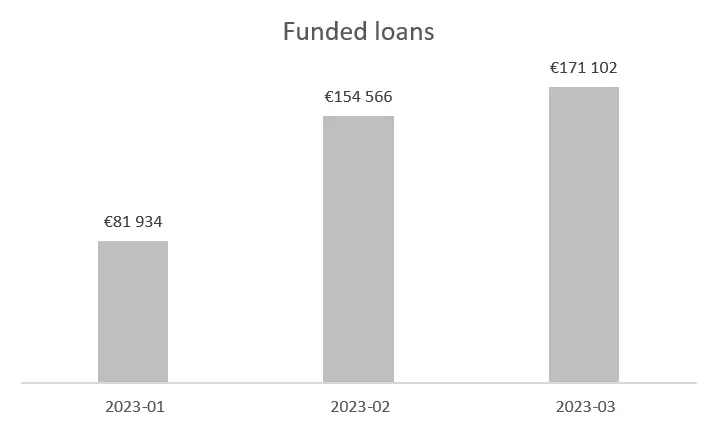

In Q1 2023, EUR 407 602 was invested in loans on the Crowdpear platform. Our investors have funded seven real estate projects in Vilnius, the capital of Lithuania, and the Vilnius region.

The average LTV of projects offered on the Crowdpear platform was up to 63%.

The average annual ROI (without additional interest) on Crowdpear last quarter was 10,68%.

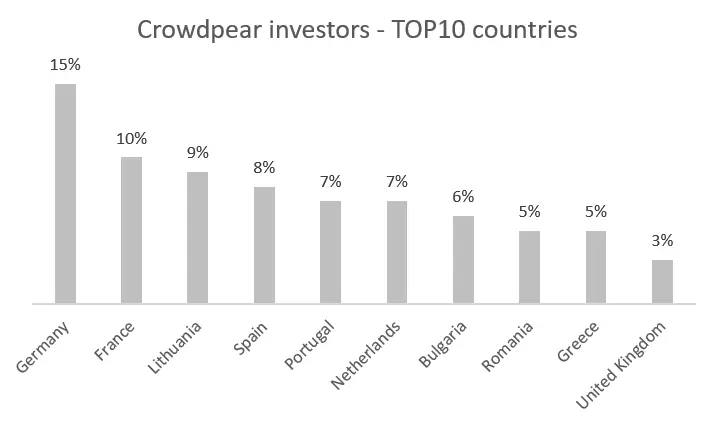

There are currently 1 369 investors in the Crowdpear investor community, 30% of which actively invest on our platform. The average portfolio size of an actively investing Crowdpear investor is EUR 1162.

Crowdpear borrowers will pay the first interest to Crowdpear investors in May.

Crowdpear has the most investors from Germany, France, Lithuania, Spain, Portugal, the Netherlands, Bulgaria, and Romania.

“We started offering investment opportunities on Crowdpear when real estate prices were more or less calibrated and a further significant decrease in real estate value in our market, especially in the largest cities, is not seen, which makes our business environment quite stable. We carefully monitor market dynamics and responsibly assess every project we offer our investors to invest in. The safety of investors’ investments is the most important for us; therefore, we review possible risks very carefully and under many parameters that include a double check of property valuation, the experience of the project developer, the developer’s discipline of covering previous obligations, etc. A primary mortgage pledges each project offered on our platform to investors, “– explains Arūnas Lekavičius, Chief Business Development Officer of the Crowdpear platform.

The main Crowdpear development plans for Q2 2023

Our nearest plans include a secondary market which is in the final development stage and should be available to our investors before the end of April (latest in May).

Since the platform is growing and we are accumulating more and more data, a page dedicated to platform statistics will be launched before the end of Q2 this year.

***

We thank you for choosing Crowdpear for your investments, and we will do our best, so you have the best experience by using our services. We would greatly appreciate it if you could share your first impressions about Crowdpear on Trustpilot.

If you have any questions or need our assistance, you are always welcome to contact us.