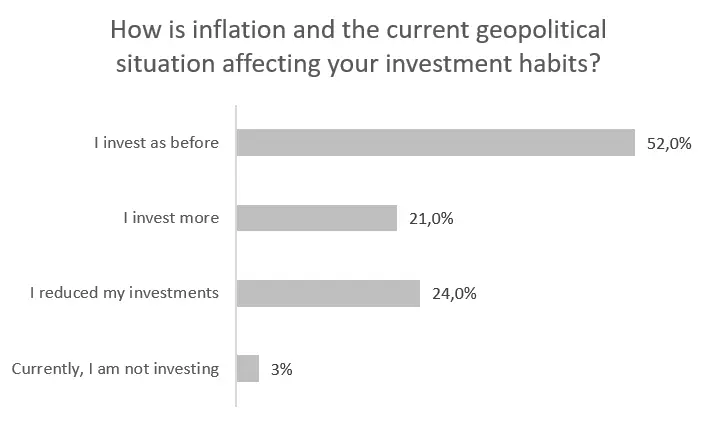

Inflation does not affect most investors – shows the investor survey conducted by our platform last month. 52% of the surveyed investors do not change their investment habits and keep their previous investment volumes. 21% of investors state they increased investments this year.

24% of survey participants have reduced investment portfolios, and 3% are currently not investing.

The survey results show that some investors seek to offset the impact of inflation by investing more and generating more income; meanwhile, some may have lower opportunities to invest due to the increased prices when less income remains for investing.

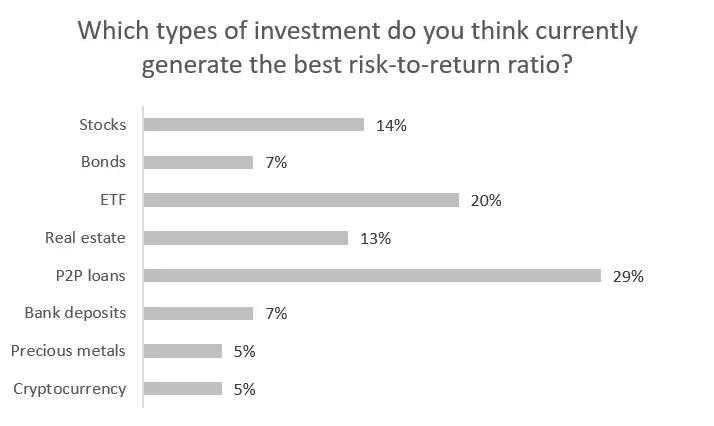

Most of the survey participants indicated investments in P2P loans (29%), ETFs (20%), stocks (14%), and real estate (13%) as currently having the best risk-to-return ratio.

The increase in interest on bank deposits made them an attractive alternative to other investment options.

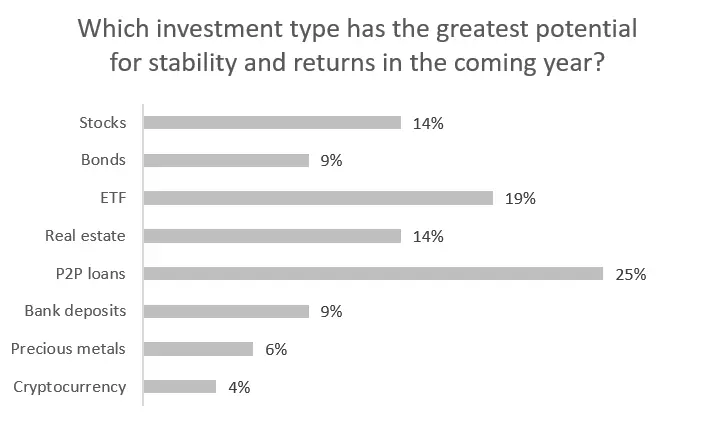

Many investors believe that investments in P2P loans (25%), ETFs (19%), stocks (14%), and real estate (14%) will remain among the most stable and attractive return-generating investments in the coming year.

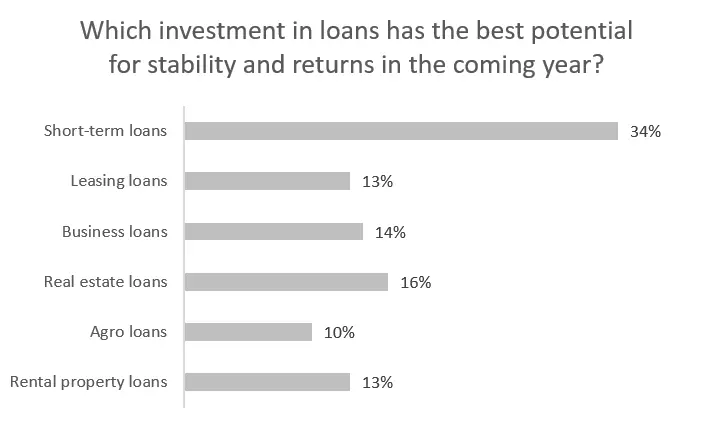

Regarding investing in loans, most investors believe that the most attractive in the coming year will remain investments in short-term loans (34%) and real estate loans (16%).

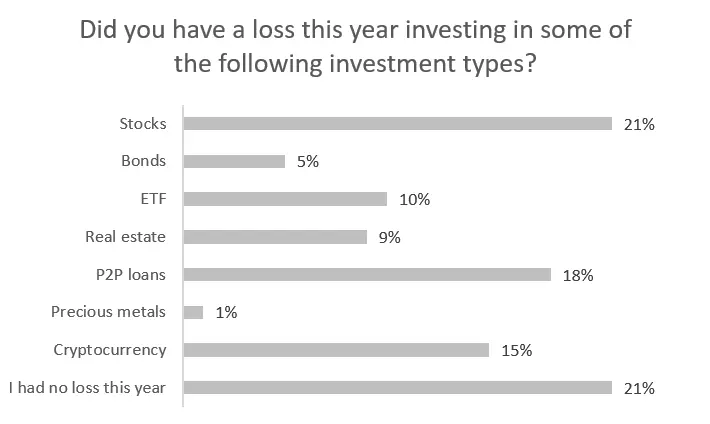

Most investors indicate they experienced losses this year when investing in stocks (21%), P2P loans (18%), and cryptocurrencies (15%). Some investors expressed disappointment with their investments in real estate, especially highlighting the German market.

21% of survey participants stated that they did not experience any losses this year.

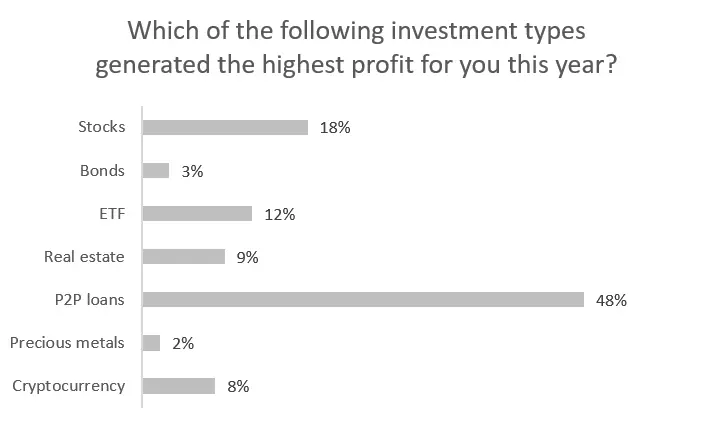

Although some investors experienced losses investing in stocks and P2P loans, almost half of the survey participants (48%) report earning the highest profits from investments in P2P loans and stocks (18%) this year.

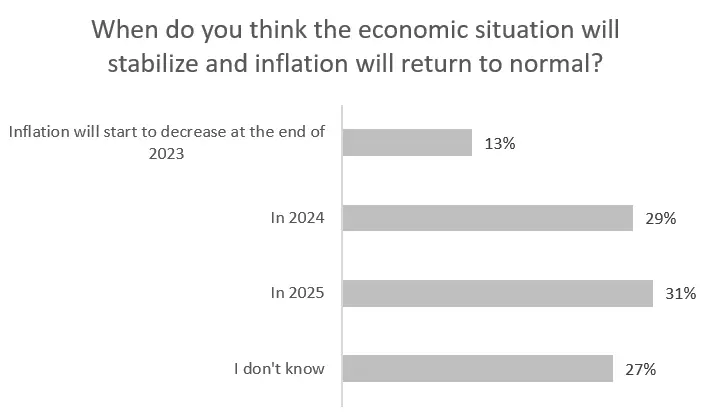

31% of investors believe inflation will normalize in 2025. 29% of the survey respondents believe the situation will improve in 2024. 13% of the surveyed investors are optimistic that inflation will start to decrease at the end of this year, and 27% say they do not know when inflation will normalize.

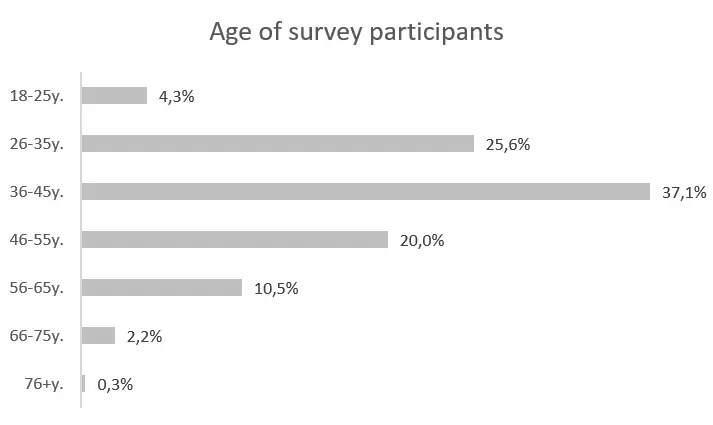

1029 investors from 46 countries, most of whom are 26-55 years old, participated in the survey on the inflation impact on investment habits.